Radar | Jan 09,2021

May 31 , 2025

By Chris Bradley , Jan Mischke

In an era marked by economic instability, the urgency for businesses to view productivity as a strategic goal has never been more acute. A new study advocates for a shift from cautious resource management to nurturing environments that enable bold and high-stakes investment decisions. In this commentary provided by Project Syndicate (PS), Chris Bradley, a director of the McKinsey Global Institute, and Jan Mischke, a partner at the Institute, argue that creativity and courage outweigh caution in the quest for productivity growth.

Few doubt that productivity growth is good for society. It generally translates into higher wages, consumer surplus (prices below what consumers are willing to pay), larger profits, and greater shareholder value. Less understood, however, is "how" productivity growth is created. New research from the McKinsey Global Institute shows that the lion's share comes from a few firms making audacious moves.

While the conventional wisdom holds that productivity growth stems from gradual, collective improvements to efficiency across many companies, our analysis suggests otherwise. A tiny number of firms are driving potent bursts of progress, because they have made bold, idiosyncratic strategic moves that force competitors to respond. Rather than a thousand or a million firms moving an inch, the real gains come from a few extraordinary firms moving thousands of miles.

We based our analysis on 8,300 companies in Germany, the United Kingdom (UK), and the United States (US), focusing especially on four sectors: retail, automotive and aerospace, travel and logistics, and computers and electronics. We used these companies to create a "lab economy," tracking precisely who was creating value and contributing to national productivity growth, and who was destroying value by dragging productivity down.

Although we looked at the relatively stable period between 2011 and 2019, after the global financial crisis but before the COVID-19 pandemic, we found similar patterns in the data from 2019 to 2023.

In our lab economy, we found that fewer than 100 productivity "standouts" account for two-thirds of the sample's growth. These are firms that added at least one basis point to their respective national sample's productivity growth between 2011 and 2019. At the same time, an even smaller number of "stragglers" made negative contributions of at least one basis point. This is a much more extreme concentration than the prevailing view of productivity would suggest.

What sets standouts apart?

In our sample, they pursued five strategic plays, often in combination, to power ahead: scaling more productive business models or technologies (such as e-commerce or low-cost carrier models); shifting regional and product portfolios toward the most productive businesses or even adjacent opportunities; reshaping customer value propositions in both mass and niche markets; building scale and network effects; and transforming operations to boost labour efficiency and reduce cost.

Thus, our case studies highlight Apple's strategic expansion into services; EasyJet shaping the discount airline trend; and, Zalando pioneering apparel e-commerce.

This lens on productivity helps us see more clearly why some countries pull ahead while others stall. While we already knew that the United States leads major European economies in terms of productivity growth, a closer look at the firms in our lab economy confirms why. Between 2011 and 2019, US productivity grew by 2.1pc a year within our sample, compared to 0.2pc in Germany and a flat zero in the United Kingdom, because the 44 US standouts outnumbered the 14 stragglers by a factor of three. By contrast, the UK had a more even distribution, with 30 standouts and 25 stragglers, whereas Germany had 13 standouts and 16 stragglers.

But it is not only about having standouts; resources should be shifted toward them. The US was itself a standout in this respect, with half its productivity growth coming from reallocating labour away from stragglers and toward the vanguard of productivity growth. In Europe, job mobility was more subdued, and the stragglers dragged down productivity growth.

This insight has major implications for policymaking.

Many current policies aim to boost welfare by supporting small firms and spreading best practices. But, if a handful of firms drive most of the gains, we need asymmetric strategies to match the pattern we observe. That means enabling faster reallocation of capital and labour, and building ecosystems that help winners scale up. Consider: If Germany could have counted 19 more standouts like the retailer REWE in the period analysed, its private-sector productivity growth would have more than doubled.

Encouraging bold moves could be even more consequential in emerging economies, where standout firms have the potential to leapfrog some of the technologies and business models deployed in advanced economies. If the kind of firms that can become standouts are fewer and further between, fast productivity growth may be difficult to achieve without deliberately nurturing potential standouts' emergence and success.

Business leaders, for their part, should stop treating productivity as a byproduct of operations and start managing it as a strategic outcome. That means tracking it, investing in it, and making gutsy calls, accompanied by resource shifts, on where to grow and where to pull back.

Amid today's economic uncertainty, companies around the world are delaying investment decisions, cutting costs, and otherwise trying to husband their limited resources. Yet the lesson from our research is that they should be doing the opposite. Real productivity growth does not come from playing it safe. It comes from creating the conditions for bold bets to pay off.

PUBLISHED ON

May 31,2025 [ VOL

26 , NO

1309]

Radar | Jan 09,2021

Radar | Jun 30,2024

Radar | Oct 27,2024

Fortune News | Jan 14,2023

Radar | May 27,2023

My Opinion | 130027 Views | Aug 14,2021

My Opinion | 126324 Views | Aug 21,2021

My Opinion | 124340 Views | Sep 10,2021

My Opinion | 122107 Views | Aug 07,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

May 31 , 2025

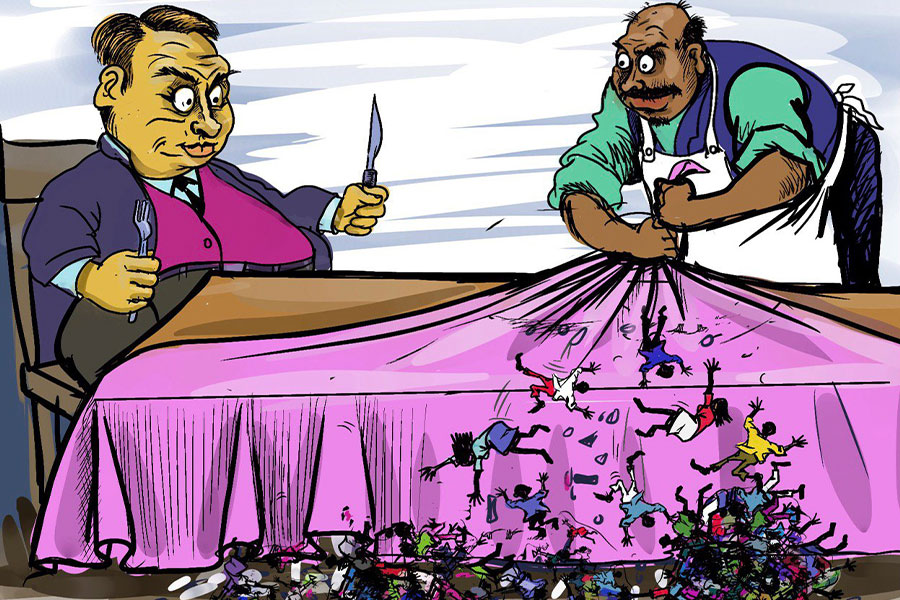

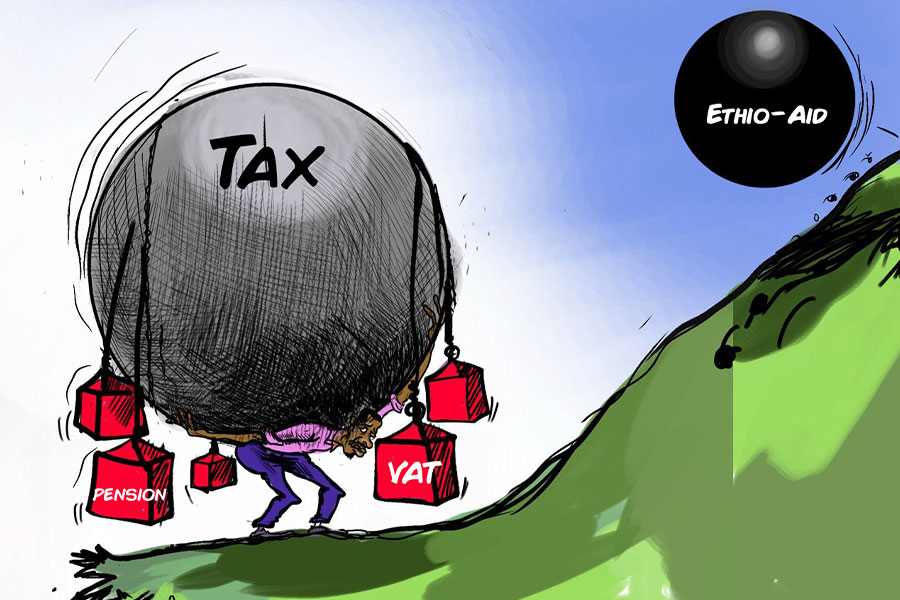

It is seldom flattering to be bracketed with North Korea and Myanmar. Ironically, Eth...

May 24 , 2025

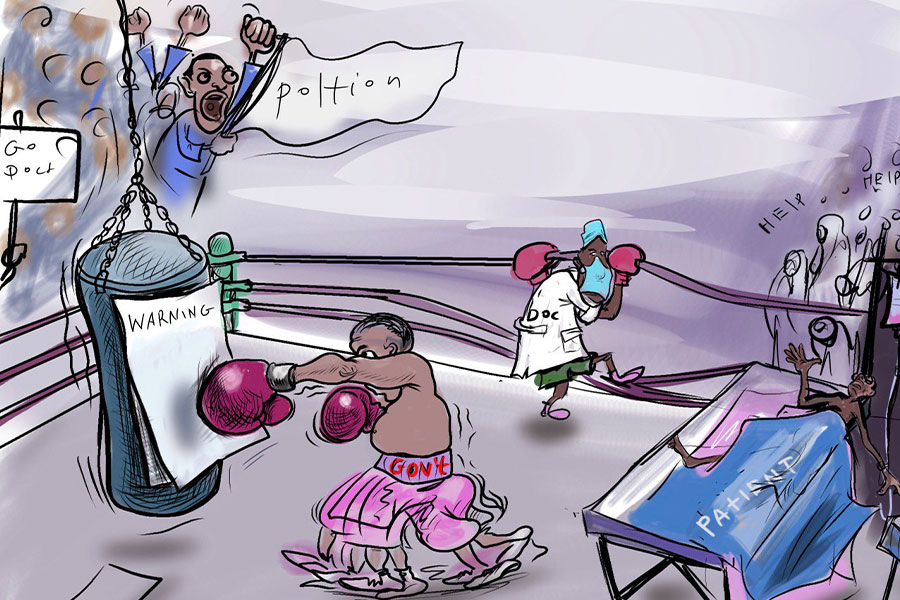

Public hospitals have fallen eerily quiet lately. Corridors once crowded with patient...

May 17 , 2025

Ethiopia pours more than three billion Birr a year into academic research, yet too mu...

May 10 , 2025

Federal legislators recently summoned Shiferaw Teklemariam (PhD), head of the Disaste...

May 31 , 2025 . By BEZAWIT HULUAGER

Real-estate developers have formed a new lobbying group, the Ethiopian Real Estate De...

May 31 , 2025 . By NAHOM AYELE

A draft proclamation, endorsed by the Council of Ministers two weeks ago, will permit...

May 31 , 2025 . By BEZAWIT HULUAGER

Regulators at the National Bank of Ethiopia (NBE) have issued a notice to commercial...

May 31 , 2025 . By NAHOM AYELE

The Ministry of Water & Energy has announced plans to enlist institutions located...